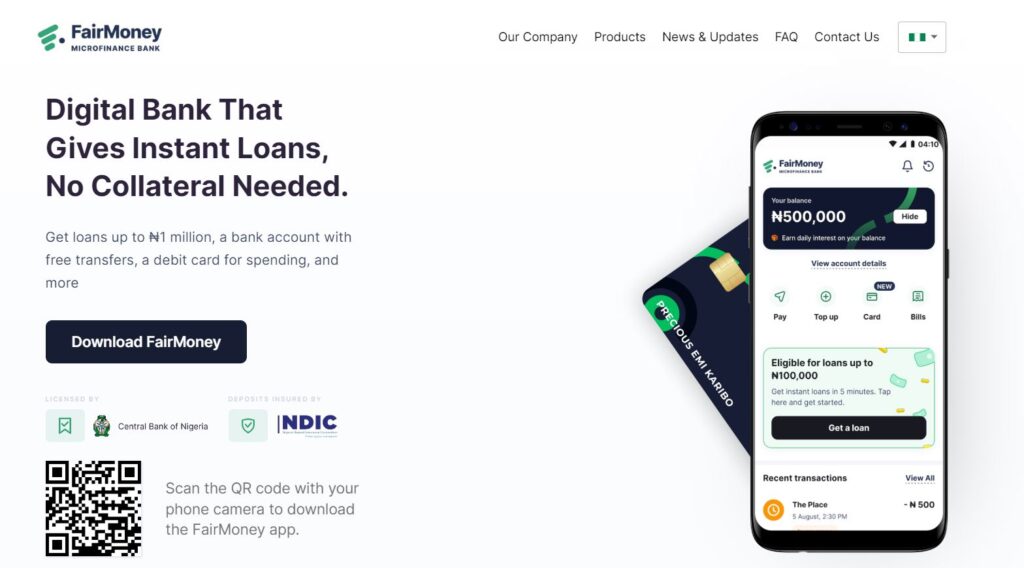

In today’s fast-paced world, speed matters, especially when it comes to obtaining loans. Conventional commercial banks often subject borrowers to a lengthy and rigid loan application process, causing frustration. As a result, in recent years, alternative loan platforms have gained popularity, with FairMoney standing out as a notable player. Here’s a comprehensive guide on how to borrow a FairMoney loan and other essential information about this app.

An Overview of Fairmoney

FairMoney is a well-known loan app that offers borrowers one-time quick loans, instalment loans, and payday loans. Borrowers are required to repay the loan with interest at the due date. Launched in March 2018, FairMoney has experienced significant growth, serving hundreds of Nigerians with loans on a daily basis.

With FairMoney, borrowers can access loans ranging from approximately ₦1,500 to ₦1,000,000, providing a wide range of options to suit various financial needs. The platform offers repayment durations ranging from 61 days to 18 months, granting borrowers the flexibility to choose a suitable loan tenure. The interest rate varies between 2.5% to 30%, ensuring competitive options tailored to individual financial capabilities.

What loan products does FairMoney offer?

Here is a list of the various loan products that the FairMoney platform offers its customers:

1. Payday Loans

Basically, FairMoney payday loans are specially designed to provide customers with monthly overdrafts. Customers that are eligible to get this loan include employees of companies, semi-governmental agencies, ministries, and other reputable institutions.

2. Personal

This loan product is majorly for salary earners, either self-employed or working public and private sectors. However, other people can also access this loan when they need emergency funds to settle a need.

3. Business

As the name implies, FairMoney business loans cater for business owners. Basically, this loan was designed to help businesses to meet their pressing expenses and expand their horizons.

Recommended: Carbon Loan App Review – Loan Types & How to Apply

How can I get a Fairmoney loan?

If you want to borrow a fast loan from FairMoney, follow these instructions:

1. First, download the FairMoney mobile loan app. This app is available on the Google Play Store only.

2. Next, launch the mobile app, tap on “Start”, then input your phone number

3. FairMoney will send you a unique verification code for your phone. Once you receive the code, enter it on the app.

4. Thereafter, fill out the online registration form to create a FairMoney account for yourself.

After you have successfully created your account, you can apply for your quick loan. To apply, follow the guidelines below:

5. Launch the FairMoney loan mobile app and tap on “Apply”.

6. On the next page you see, enter the necessary information. You will receive your loan offer after this.

7. Input the loan amount you would like to borrow. Ensure that it doesn’t exceed your loan offer.

Lastly, input your bank details. FairMoney will credit your account with the stipulated amount of the loan in less than 5 minutes (if your application is approved).

What documents do I need to get a FairMoney loan?

Before you can obtain a loan on Fair money, you need these documents:

1. Valid means of Identification

2. BVN

3. Phone number

Also, you must be at least 18 years old and have a functioning bank account and an android smartphone.

How can I pay back my Fairmoney loan?

There are four ways you can repay your loan on the FairMoney platform. They include:

1. Launch your app and find “Loan Details” on the home page. Click on it.

2. Next, tap on the “Pay” button.

3. Choose the “Full Loan Amount” option to pay off your loan at once. If you want to pay part of it, select the “Enter Amount” option and input the amount you wish to repay.

B. Bank Transfer

1. Launch the app and pick ‘Bank Transfer’ as your payment method

2. You’ll see a unique Providus Bank account number that has been assigned to your FairMoney account ONLY.

Make payment into this Providus account through transfer or at any Providus bank location.

C. USSD transfers

Dial your bank’s USSD code, followed by the amount you want to pay back, and then the unique Providus bank account number. This will automatically transfer the funds and pay back your loan. Fairmoney USSD loan code is only available to borrow loans and not repay them.

D. For Debit Card payment

To transfer payment through a debit card, go to the platform and pick “ATM”. The platform will display the card you registered with your account. Thereafter, click on the debit card of your choice and tap the “Payment” option. The loan amount will be debited directly from the registered account that is linked to the ATM card.

Read Also: Opay loan code – How to Borrow Loan in 3 Easy Steps

How much loan can I get on FairMoney?

The loan amount this platform pays customers ranges between ₦1,500 to ₦1,000,000, based on your credit score. The loan repayment duration is between 61 days to 18 months.

What is Fairmoney Loan Interest Rate?

On the FairMoney loan platform, the monthly interest rates range between 2.5% to 30% (APRs from about 30% to 260%). For instance:

Basically, if you borrow ₦100,000 to pay back within 3 months, and the interest rate is 30% of your loan, you pay an interest of 30,000 plus your principal loan amount. This means that you repay a total amount of 130,000 at the end of the 3 months.

You can choose to pay back this amount at once or schedule it into monthly payments.

Is FairMoney Loan App Legit or a Scam?

At this point, you may be wondering if FairMoney is a legit loan platform. The short answer to that question is Yes. FairMoney is 100% legit. Therefore, you can borrow money without getting scammed.

In fact, FairMoney has fully evolved into a digital bank as it has received an official license from the Central Bank of Nigeria (CBN) to operate.

Who owns Fairmoney?

Laurin Hainy, a renowned tech expert owns the FairMoney digital banking and loan platform. He is both the Founder & CEO of the FairMoney platform.

How can I contact Fairmomey?

Here are some reliable ways to reach out to FairMoney:

Address: 28 Pade Odanye close, off Adeniyi Jones, Ikeja, Lagos, Nigeria

Email Address: help@fairmoney.ng

Phone Number: 01 7001276 / 01 8885577

Website: www.fairmoney.io

Conclusion

The FairMoney platform serves as both a digital bank and a loan platform. Hence, it is an all-in-one app to access a variety of services. If you want to learn how to borrow a FairMoney loan, the guidelines above outline all you need to know.