In recent years, Loan apps have gained immense popularity for their hassle-free nature, allowing users to apply for loans without collateral or excessive paperwork. Many Nigerians prefer these quick loan platforms over conventional banks. Among the reputable loan apps, Carbon stands out as a credible and professional fintech organization. This comprehensive Carbon loan review covers all you need to know about this platform.

An Overview of Carbon Loan App

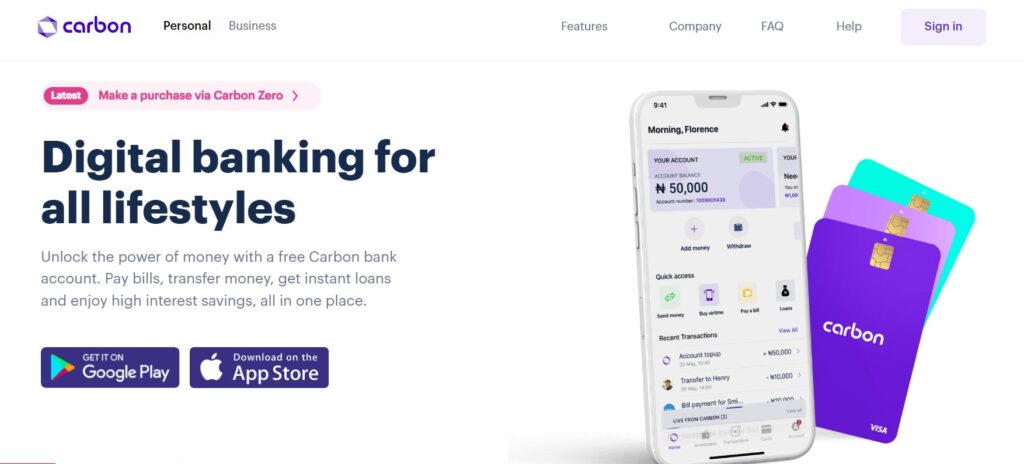

Formerly known as Paylater, Carbon is a renowned fintech organization in Nigeria that offers instant loans to individuals. In addition to quick loans, the platform provides a convenient way to send and receive money, pay bills online, and invest funds to earn high returns.

The company, initially named Onefi (Onefinance), was founded in 2012, offering short-term loans of up to an impressive N1,000,000 within 24 hours. After rebranding to Paylater in 2016, the platform eventually settled on the name Carbon. The Carbon Loan platform primarily caters to salary earners in urgent need of funds for personal needs. It boasts a wide array of financial services, including personal and business loans, payments, funds transfers, credit scoring, savings, and investments.

The Carbon loan application process generally takes about 5 minutes to complete. Their loan rates range between 2% to 30%, depending on the amount of loan you borrow and the stipulated repayment period.

How does Carbon Loan App Work?

As stated earlier, Carbon offers both personal and business loans to Nigerians. The personal loan amount you can borrow from this company is N1,000,000. On the other hand, businesses can access instant loans of up to N20,000,000 within just 48 hours to help expand their business.

As for charges, Carbon charges a 5% fixed fee for SME loans (for new applicants). However, the platform charges only 4% for returning customers with no hidden fees. The interest rates on personal loans are very competitive and usually vary depending on the borrower’s credit history.

Recommended: Opay loan code – How to Borrow Loan in 3 Easy Steps

How do I get a loan from Carbon?

To get a loan from the Carbon loan platform, follow the guidelines below:

1. First, download the Carbon app from Google Play Store or the App Store for iPhones.

2. Next, launch the app and enter the necessary information on the sign-up page. They will need to give details like your full name, BVN, Date of birth, a valid ID, etc

3. Once you submit this information, the platform will review your details and approve it if it is correct.

After the platform approves your details, you will be able to view your loan limit. You can apply for loans depending on your loan limit. Do this to apply for a loan:

4. Click on the “Request a loan” tab.

5. Next, input the amount you wish to borrow and give reasons for applying for the loan.

6. The platform will let you know if your loan application process was successful or not.

If they approve your loan, they will ask you to provide your card details to credit you. Repaying your loan on time will make you qualified to apply for a higher loan amount and at a lower interest rate.

How long does it take to get a loan from Carbon Loan?

Generally, the platform approves loans instantly. Hence, you should expect to receive the money in your bank account within 5 minutes. In less than 7 minutes, you should be able to register on Carbon and apply for a personal loan.

How much can I get as a loan from Carbon Loan?

Carbon offers individuals loans of up to 1 million Naira. However, this all depends on your credit profile as well as your last loan status. So if you owe any loan app, you may not be able to access a huge amount of loan on this platform.

How much is Carbon Loan Interest Rate?

Carbon interest rates vary from 2% to 30%, depending on the amount you borrow and the loan repayment duration. If your loan repayment period is just one week, you will have a lower interest rate on your loan, unlike another person who borrows for 4 weeks.

How can I Repay a Carbon Loan?

Repaying your Carbon loan is quite easy and it is automated. Here is how to repay your Carbon loan:

1. Fund your Carbon account with the stipulated loan amount and its interest.

2. On the repayment date, the platform will automatically debit your account, taking the amount of loan you owe.

Alternatively, Carbon can deduct the money from the account that is linked to their platform (you need to provide this during registration). If they debit your account, you will be charged a 1% fee on every of your loan repayments.

What is Carbon Loan USSD Code?

Besides mobile banking, the Carbon platform also provides customers with the USSD banking code option. The official Carbon loan USSD code is *1303#. You can use this code on both your MTN and 9mobile networks.

Who Are the Owners of Carbon Loan?

Carbon was established by two brothers, Chijioke Dozie and Ngozi Dozie. The organization has gone on to raise funding of about $15.8 million from investors all over the world. This has led to their growth and popularity in the past few years.

Read Also: Access Bank USSD Code – How To Get A Loan From Access Bank

How can I download the Carbon Loan App?

Follow these steps to download this Loan App

1. Visit the Google Play Store (Android) or App Store (iOS).

2. Next, search for “Carbon”

3. Download the app and sign up using your details.

Is Carbon loan legit?

Yes, Carbon is a legit loan platform that is approved by the appropriate Nigerian authorities. Hence, you do not need to worry about getting scammed. As long as you download the correct app and follow the steps above, you can borrow a loan in less than 10 minutes.

How can I contact Carbon Loan?

You can reach out to Carbon Loan app through any of these ways:

Address: CCMF+3PH, Adeyemo Alakija St, Victoria Island 100001, Lagos

Email Address: customer@getcarbon.co

Website: www.getcarbon.co

Wrapping up

The Carbon loan review above will guide you through everything you need to know about the loan and banking platform. Just download the app, borrow a loan, and use it to settle your pressing needs. However, make sure you pay back on time to qualify for a higher loan amount.