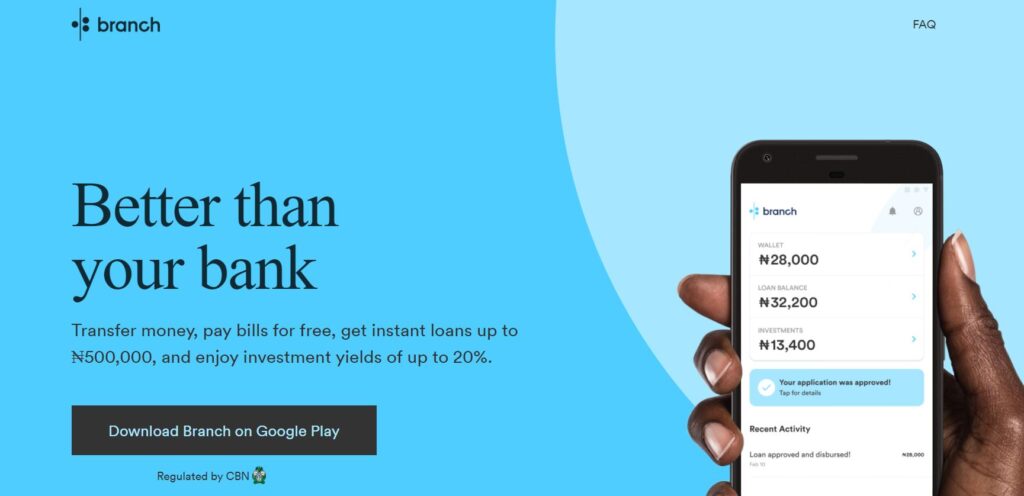

The digital age has revolutionized various sectors of the economy, including banking. Today, with just a smartphone and an internet connection, you can access banking services without leaving the comfort of your home. Branch is an all-in-one digital platform that offers banking, loan, and investment services, simplifying your financial journey. This comprehensive review will delve into the features and benefits of the Branch platform.

An Overview of the Branch Loan App

Branch is a digital platform that seamlessly facilitates fund transfers, high-yield investments, and instant loans, providing users with a collateral-free loan experience akin to a digital bank. Launched in 2015, the app became available to all Nigerians in 2017, quickly gaining popularity and amassing over 1.2 million users. The platform’s remarkable growth is further evidenced by the disbursement of over one million loans, totalling more than N9 billion in Nigeria.

Branch’s primary offerings include convenient fund transfers, attractive high-yield investments, and instant access to collateral-free loans. These services cater to the diverse financial needs of users, earning the platform a reputation for reliability and trustworthiness. The Branch mobile app is readily available for download on the Google Play Store, catering to Android users. As of now, the app is not yet available on the App Store. Branch currently operates in Nigeria, Mexico, Kenya, India, and Tanzania, reaching a wide user base across multiple countries.

What services does Branch offer?

The Branch loan app currently has three services they provide to customers. So as one of their users, you can access any of the services. These services include:

1. Branch Wallet

Branch Wallet is a digital wallet that allows you to execute reliable transfers of funds, pay bills and purchase Airtime & Data with no extra charges. Currently, the maximum amount of money you can keep in your Branch Wallet is N500,000. Basically, the maximum amount of funds you can deposit and withdraw from the Wallet is N100,000 for each transaction. You can instantly fund your Wallet with either a bank transfer, Branch loan, or debit card.

2. Branch Investment

Another service that Branch offers its users is the investment service. The investment package is divided into two products; the Flexi and Fixed products. Basically, Flexi investment package allows you to deposit any amount of money and withdraw it at any time you want after 24 hours.

However, the Fixed investment package is more rigid. The Fixed package lets you deposit a minimum amount of ₦1,000 for a duration of 1- 12 months. After maturity, you will receive your investment capital and its returns.

3. Branch loan

The Branch loan is specially designed to meet the l needs of its customers and help them grow. Their loan amount ranges from between ₦1,000 to ₦200,000 while the repayment period is between 4 to 40 weeks.

As you build credit by paying back your loans on time, you will be able to borrow larger loan amounts on the app. Branch’s loan interest range is between 17% – 40%

Recommended – What is FairMoney Loan USSD Code?

How Do I Get A Loan From Branch Loan App?

Borrowing a loan from the Branch loan app is very easy. In fact, you can do it within less than 20 minutes. Follow these instructions below to access a loan:

1. Download the Branch mobile Loan app from Google Play Store. This app is only available to Android users via the Google Play Store.

2. Next, create an account by registering your details on the online form. Make sure that your details are accurate as the platform will access this before approving your loan.

3. Find out the loan amount you’re eligible to receive.

4. Apply for a loan depending on your loan amount limit.

5. Receive the money in your bank account in not more than 24 hours

How much interest do I receive on my Branch Investment?

The interest on the Branch Flexi package is 15% per annum. Usually, the platform will calculate your interest daily and pay it to your wallet on Mondays every week. You will be able to withdraw this fund after its maturity date.

On the other hand, the interest on the Fixed Investment package is 20% per annum. The platform will pay you your interest out to your Flexi balance when your Fixed investment package matures.

How long do I get before I pay back my Branch Loan?

Branch gives borrowers enough time to pay back their borrowed money. Usually, the duration ranges between 2 weeks to 3 Months.

What is the transaction limit on Branch Loan app?

When you create a Branch account, the platform will automatically decide your transaction limit based on your level of verification. Here is a breakdown of the transaction limit for each level:

A. Level 1

• Normal Transaction limit – ₦50,000

• Amount Balance Limit – ₦300,000

B. Level 2

• Normal Transaction limit – ₦100,000

• Amount Balance Limit – ₦500,000

C. Level 3

• Normal Transaction limit – No Limit

• Amount Balance Limit – No Limit

Hence, if you want to upgrade your transaction limit, you need to upgrade your level by providing more details about yourself.

Recommended: FairMoney Loan – Types & How to Apply

What documents do I need to register on the Branch Loan app?

Here is a list of the basic details you need to open a Branch account online:

- Full name

- A valid means of Identification

- BVN

- Email Address

- A functional bank account number

- Phone Number

How can I contact Branch?

Here are the different ways you can reach out to the Branch platform:

Email Address: nigeria@branch.co. Or nigeria@branch.co

Website: support@branch.co.

Alternatively, you can contact them through the customer care service on Branch mobile app.

Bottom Line

With the Branch platform, you can send and receive funds, invest, and apply for quick collateral-free loans. Basically, it’s like an all-in-one app that meets your banking and financial demands. To access this platform, just use your Android device to download the app, create an account, fund your wallet, and transact. Many users choose this platform because of its easy transaction process and high-yielding investment packages.