The Stanbic IBTC EZcash loan is one of the loan products from Stanbic IBTC that is specially tailored to meet the needs of SMEs. Essentially, this loan package is for entrepreneurs who are still struggling to find their feet in the world of business. EZcash gives your business a soft landing financially so that it can operate more efficiently. Check out how you can apply for this loan in the guide provided below.

What is EZCash?

Stanbic IBTC EZCash is a term loan that provides all qualified active current account holders of Stanbic IBTC quick access to cash varying from N20,000 to N4,000,000. You get this for a duration of up to 12 months with no need for documentation or collateral.

What Are the Advantages of Stanbic IBTC EZCash Loan?

Here are the reasons why this loan package is a good offer for entrepreneurs:

- Access to a total of 5 million loan instantly

- A low interest rate of just 2.5% per month

- Comfortable repayment plan that is distributed across 6 to 12 months

How Can I Borrow a Stanbic IBTC EZCash Loan?

Essentially, there are three ways to access the Stanbic IBTC EZcash loan. They include

A. Through the website

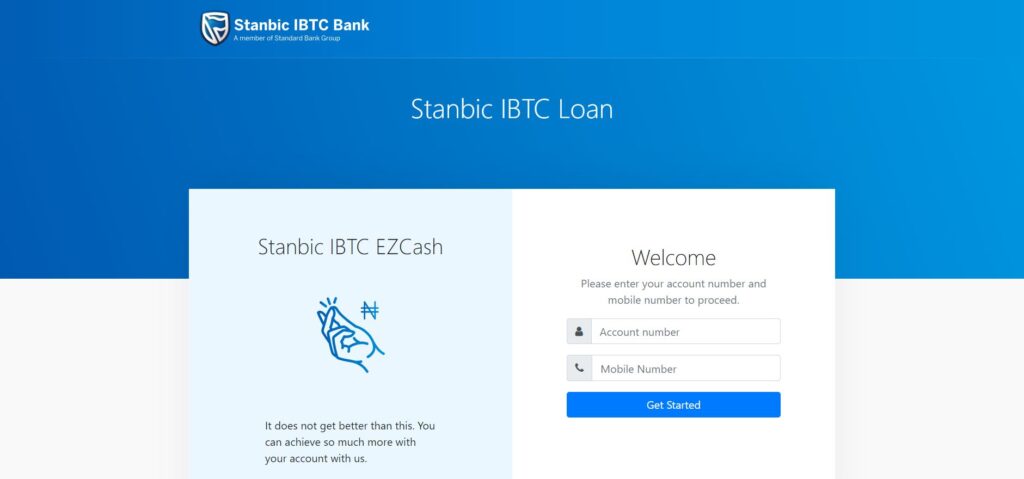

1. Visit the EZCash loan portal first. Tap on the link to lead you to the platform.

2. Next, enter your Stanbic IBTC account number and your phone number.

3. Tap on “Get Started”

4. Thereafter, fill out the rest of the loan application form by providing the right details.

If you are eligible for the loan amount you applied for, it will be disbursed into your account within a few minutes.

Read Also: IPPIS Loan in Nigeria – Everything You Need to Know

B. Through the Stanbic IBTC app

1. First, sign into your Stanbic IBTC mobile app or internet banking and tap on “Request EZCash”.

2. Next, input all the necessary details for the loan. You have to input the amount of loan you intend to borrow and your scheduled repayment period

3. The system will evaluate your credit score to know if you are qualified for the loan. If you are eligible, they will notify you of the interest rate applicable to the loan. Confirm this interest rate to continue the application process.

4. Read through the terms and conditions of your loan and click on “accept”. Note that once you accept these terms, you’ve agreed for your account to get debited automatically if you default on the loan repayment date.

5. Input your debit card details.

Once this is done, Stanbic IBTC will automatically credit your account with the cash you request immediately. It is that simple.

C. Through the USSD code

1. Start by dialing *909*44# on your phone

2. Next, follow the prompts and select “Request EZCash”.

3. Input the amount you want to borrow.

4. If you are eligible for that amount, it will be disbursed to your account immediately.

How Do I Qualify For The EZCash Loan?

Here are the requirements you have to meet to qualify for this loan:

1. You must own an active account with Stanbic IBTC Bank. This account should be at least 12 months old.

2. You must not be below 18 years old and be above 59 years.

3. You must not be indebted to any bank or platform or have any past history of dud cheques.

4. Your credit reports must be satisfactory.

What is the Interest Rate on The EZCash Loan?

The appropriate interest rate you have to pay on any amount of EZcash loan you receive is 2.5%. Note that this charge will be deducted per month.

What Are the Charges/Fees?

Here is a list of the charges and fees your loan will attract:

- Management fee of just 1% on any amount you borrow

- Value Added Tax (VAT) of just 0.05% on any amount you borrow

- Insurance fee of only 0.35% on any amount you borrow

How Many Times Can I Borrow?

The number of times you can borrow this loan is unlimited as long as your cumulative loan amount doesn’t exceed the amount you are eligible to borrow. To increase your loan limit, ensure you repay the loan on time and actively use your account.

Exciting Read: EaseMoni Loan – Get a Loan in 3 Easy Steps

What Are The Factors That Affect My Loan Limit?

Your loan limit primarily depends on the average income you receive monthly as well as your monthly loan repayments on the previous loan you borrow. This implies that your salary per month and how well you repay the loan will determine the loan amount you are qualified to borrow.

What is the Loan Tenor of the EZCash Loan?

The loan tenor for the EZcash loan by Stanbic IBTC bank varies between 1 to 12 months. Note that your specific loan tenor will be estimated and displayed by the system when you are applying for the loan.

What is the Maximum Amount of Loan I Can Borrow?

The loan amount for this product ranges between N20,000 to N4,000,000. So your maximum loan amount depends on the criteria listed above.

How Can I Contact Stanbic IBTC Bank?

Here are some ways you can reach their customer service to inquire about this loan:

Local: 0700 909 909 909

International: +234 700 909 909 909

Email Address: CustomerCareNigeria@stanbicibtc.com

Website: www.stanbicibtcbank.com

Alternatively, you can visit any Stanbic IBTC bank branch near you and make inquiries about the EZcash loan and how to get it.

Bottom Line

Due to its fast disbursement, we recommend the Stanbic IBTC EZcash loan for both business owners and salary earners who need money urgently. As long as you own an active account with the bank, you can apply for this loan immediately. Also, another advantage of this loan is its low-interest rate, which is just 2.5% per month. In all, we can say that this is one of the best loan packages you can receive as one of Stanbic IBTC bank account holders.