If you need a N5 Million loan within 5 minutes, then you should check out the Specta loan platform. Essentially, this platform is one of Sterling Bank’s products that was specially designed to reach both the employed and the unemployed population. This article will discuss how you can borrow up to five million Naira within 5 minutes.

An Overview of Specta Loan

Specta is one of Nigeria’s fastest loan platforms that can give you access to instant loans of up to N5 Million in less than 10 minutes. The best part is that you don’t need to provide any guarantor, unnecessary documents, or collateral. You don’t even need to visit any physical office as the application, processing, and disbursement is done online.

Specta is one of Sterling Bank’s loan products that aim to provide Nigerians with a way they can access huge loans quickly and conveniently. This platform uses proprietary data and extensive analytics to review and confirm all loan applications. So you won’t have to visit any Sterling bank branch to do anything.

What are the Loan Packages on the Specta Platform?

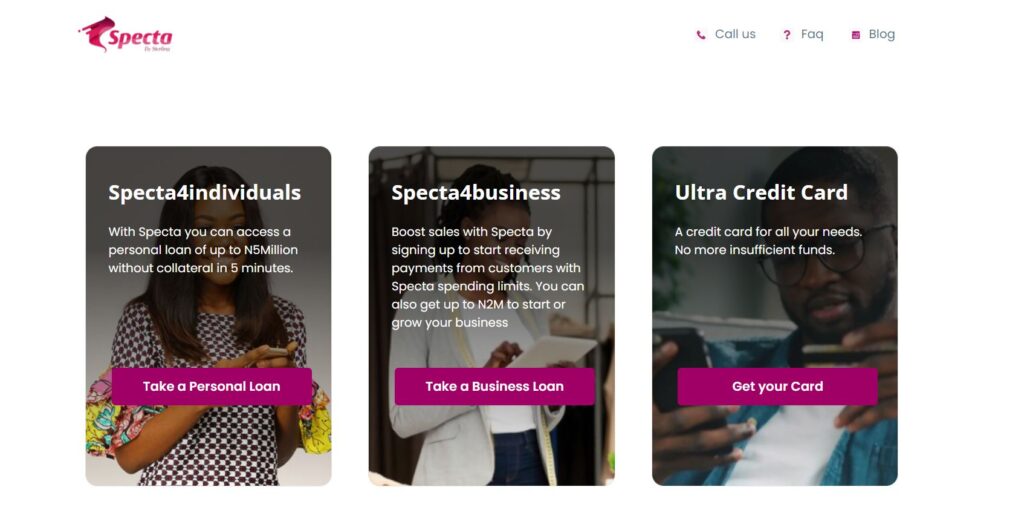

Here is a list of the loan packages that Specta has to offer:

1. Specta4Individuals

The Specta4Individuals package is available for both people who earn a salary and people who don’t earn a salary. Here is what you should know about this package:

a. Salaried Individuals

You can obtain a personal loan from the Specta platform if your main salary account is domiciled with Sterling Bank or any other Bank in Nigeria. This package is open to all salary account holders in Nigeria.

b. Non-Salaried Individuals

Even if you are self-employed, you can still access the Specta non-salaried loan. Basically, this loan is available for traders, business owners, as well as professionals who have accounts with Sterling Bank or any other bank in Nigeria.

Recommended: Lotus Bank Loan – Types and How to Apply

2. Specta4Business

This package allows you to boost your business sales. All you have to do is to sign up and start accepting payments from your clients with Specta spending limits. Also, this package can give you access to up to N2 Million for you to start or expand your business.

3. PayWithSpecta

The PayWithSpecta product provides you with instant digital credit limits. Basically, this credit limit can be used to buy items from both physical stores at specific merchant locations and online stores. Also, you can withdraw cash from your credit limit.

4. Ultra Credit Card

This is a revolving Naira designated card that is available for all Specta customers. Basically, this card is tailored to suit your short-term loan needs.

5. Specta Score

The Credit score package helps other banks and financial institutions to evaluate their customer’s risk for loan purposes. In turn, this assists their customers in making smart decisions in managing their finances.

6. Specta Prime

This package enables you to access instant loans/credits that you can back up with any of your investments. With Specta Prime, you can invest at a competitive rate and obtain a loan at a subsidised rate.

How Can I Apply For Specta Loan?

To get a loan from Specta, you have to first get profiled by the platform. To get profiled, do this:

1. Download the Salary Domiciliation form and fill out the form.

2. Email the completed form to Specta. We’ve provided their email address below.

Wait for their customer service to give you feedback. Once you get profiled, follow these other steps:

3. Visit the website, www.specta.com and tap on “Get Started”.

4. Thereafter, tap on the loan package you will like to apply for.

5. Enter your information and you will receive the amount of the loan you applied for within 5 minutes.

What is the Interest Rate on Specta Loans?

Essentially, the interest rate on this kind of loan is generally between the range of 25.5% – 28.5%. However, your loan application will incur some other charges. These charges include:

- One-off payment for the insurance: 2.5%

- One-off payment for management fees: 1%

- Penalty fee: 1%

Read Also: Mint Loan – How to Get a Loan in 5 Minutes

What is the Repayment Period for Specta Loans?

Generally, the repayment duration for any loan you obtain from the Specta platform is between the range of 1-12 months. Note that late repayment of your loan will attract a penalty fee of 1%.

How Much Loan Can I Borrow From Specta?

The minimum amount of loan you can borrow from this platform is N50,000 while the maximum amount of instant loan you can access is N5,000,000.

What Documents Do I Need To Apply For a Loan on Specta?

Here is a list of the documents this platform will need you to provide:

- Your bank account number

- BVN (Bank Verification Number)

- A valid Email address

- Valid Means of Identification

How Can I Contact Specta Loan?

For more information about Specta loans, you can reach out to their platform via any of these ways:

Address: Sterling Towers, 20 Marina, Lagos Island, Lagos, Nigeria.

Phone Number: 017004271

Email Address: specta@sterling.ng

Website: www.myspecta.com

Conclusion

If you are a staff in any organization or even a business owner who needs an emergency loan, then the Specta loan platform is suitable for you. The platform is 100% legit and disburses millions of Naira within 5 minutes. Just get profiled and apply for any loan package on the platform. Don’t forget to reimburse your loan on or before the due date.